The Capital Asset Pricing Model (CAPM) is a financial investment decision-making tool widely utilized by financial professionals and portfolio managers. Regarding risk and return, CAPM was the first model to accurately evaluate the connection, allowing investors to establish their expectations. A risk-adjusted analysis of possible investments is carried out using this component.

The Capital Asset Pricing Model: Definition and Examples

Using the risk factor, the Capital Asset Pricing Model (CAPM) is a method for evaluating possible investments and determining their projected returns. When making investing decisions, financial experts and portfolio managers rely on this tool regularly.

In the early 1960s, CAPM was established to calculate expected returns by factoring in risk. Dr. Thomas Smythe, Professor of Finance at Florida Gulf Coast University, told The Balance in an email that CAPM constituted two key advancements in financial theory.

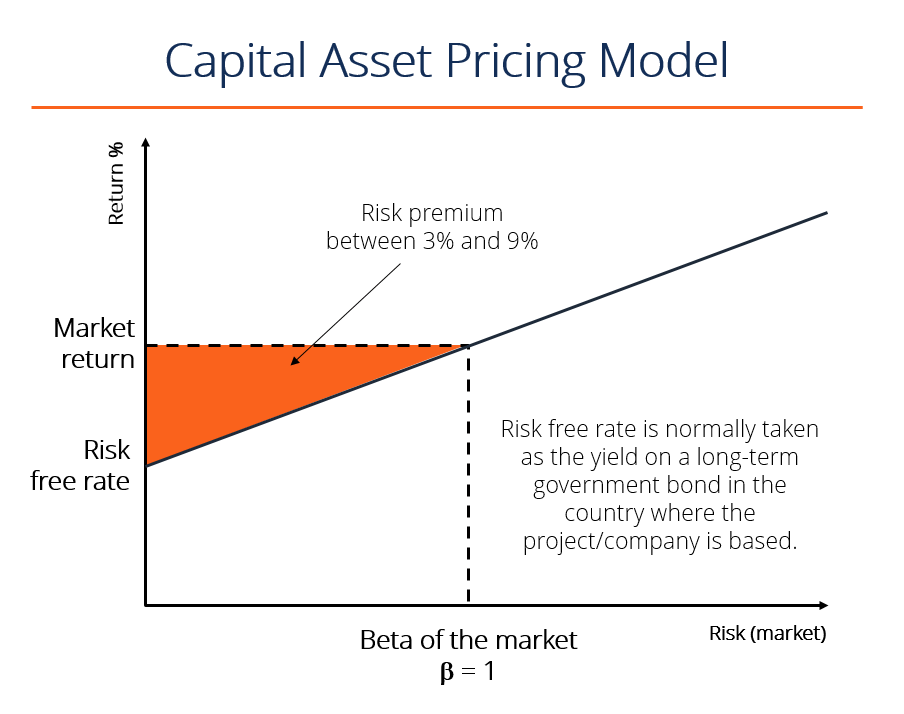

Our unsystematic risk may be almost eliminated through diversification, so only market or systematic risk is left to contend with. A key feature of CAPM is that it states that all stocks should be evaluated according to their beta, which measures how exposed they are to market risk.

The CAPM may be used to analyze any investment, not only equities. Regarding benchmarking returns, portfolio managers might utilize CAPM as an example. Investors can use CAPM to assess the effectiveness of their portfolio managers. CAPM is a tool used by corporate finance managers to weigh the risks and rewards of new investments.

Capital Asset Pricing Model: The Theory and Practice

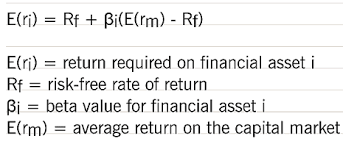

Analysts can use a calculation provided by the Capital Asset Pricing Model to calculate the expected returns on a specific asset.

The formula for CAPM is

Risk-Free Rate x Expected Return (Market Risk Premium x Beta)

Percentage of Money You Don’t Have to Risk

Due to the low risk of issuer default, the U.S. Treasury’s six-month or 10-year bond rate is sometimes referred to as the “risk-free rate” in financial markets.

Price of Risk Premium in the Market:

The return investors receive over the risk-free rate, or in other words, compensation for accepting the risk is known as the “market risk premium.” The risk-free rate is subtracted from the predicted market return of a broad index like the S&P 500 to get at the market risk premium. The portfolio beta is used to modify the market risk premium.

Risk and return are calculated using the CAPM’s beta model. The total price fluctuations of an asset or a portfolio are compared to the overall market price changes using the beta metric.

The betas of stocks and other investments may be calculated using linear regression. For example, the S&P 500 index fund has a beta of 1, which means that the fund will rise or fall with the market. If the XYZ firm stock’s beta is 1.1, it will increase or fall 10% more than the stock market’s movement.

The capital asset pricing model may be used to examine the performance of an actively managed ABC fund.

4.64 percent is the risk-free rate.

A 9.7 percent increase in the cost of risk.

Beta for ABC Fund: 1.30

ABC Return on investment for a decade: 16.71%.

So, armed with this data, you may estimate your profit margin.

Total expected profit = 4.64% plus (9.7 percent x 1.30)

So, you may expect a 17.25 percent return on your investment. In comparison, you can see that the real return was 16.71%.

The link between systematic risk and expected return on assets, particularly equities, is described by the Capital Asset Pricing Model (CAPM). Financial institutions utilize CAPM extensively to price hazardous securities and calculate projected returns on assets, given the risk and cost of capital of such assets.

Acquainting Yourself with the CAPM:

The formula for determining an asset’s expected return, taking into account its risk, is:

\begin{aligned} where: &ER i = ‘text’ anticipated return of investment; &R f = ‘text’ expected return of investment In this example, the word “risk-free rate” is replaced with “text beta of the investment,” and the result is calculated as follows: text beta = “text beta of the investment.” aligning the end of the market risk premium text

An investor’s expectation of profit is represented by the expression “anticipated return on investment,” which may be written as follows:

The risk-free rate is denoted by the symbol Rf.

I = beta of the investment (ER m R f) = market risk premium

Investors expect to be reimbursed for compensating for risk and the time worth of money. The time value of money is considered in the CAPM calculation via the risk-free rate. The other parts of the CAPM formula assume the increased risk the investor is taking.

An investment’s beta tells you how much risk it adds to a portfolio that looks like the market. It indicates that the stock has a higher beta than the overall market. According to the formula, betas lower than one is assumed to lessen portfolio risk.

To calculate an asset’s worth, investors need to know the return or discount rate they may employ. In order to calculate a stock’s beta, we must first multiply the expected return on an investment by the market risk premium. Financial tips based on the Capital Asset Pricing Model (CAPM) can help investors make informed decisions about their portfolios. The risk-free rate is then multiplied by the stock’s beta and the market risk premium to arrive at the stock’s beta-risk premium.

The CAPM formula determines if a stock’s risk and time value of money are reasonably valued concerning its predicted return.

Consider the case of a $100 per share stock that pays a 3% yearly dividend, for example. The stock has a beta of 1.3, which indicates that it is more volatile than the overall market. The risk-free rate is 3%, and the investor anticipates the need to increase in value by 8% every year.

The CAPM formula predicts a 9.5% return on the stock:

“begin-aligned” &9.5% = 3% + 1.3 times” (8 percent – 3 percent) “end-aligned”

A 9.5 percent rate is equal to 3% + 1.3% = (8%-3%).

Using the CAPM formula’s projected return, investors may discount the stock’s future dividends and capital gains over the predicted holding term. The CAPM formula says the stock is properly valued concerning risk if the discounted value of those future cash flows equals $100.

CAPM Formula for Equity Costs:

The CAPM formula simply needs three pieces of information: the general market return rate, the stock’s beta value, and the risk-free rate.

COST OF EQUITY = Risk-Free Return + Beta x * CAPM Formula (Market Rate of Return – Risk-Free Rate of Return)

The theoretical return on investment with z is the no risk-free rate of return.

What Can You Learn from the CAPM?

The weighted average cost of capital includes the cost of equity (WACC). WACC is frequently employed to estimate the total cost of capital under various financing schemes. WACC is commonly used in the search for the most cost-effective combination of debt and equity financing.

Assume that ABC Company is listed on the S&P 500 and has a 10% return. The company’s stock has a beta of 1.2, which is somewhat higher than the market’s. The three-month T-bill risk-free rate is 4.5 percent.

According to this data, the company’s equity borrowing costs 11 percent:

10% – 4.5% = (1.2 * (10%) + 4.5% = Cost of Equity.

Final Thoughts:

In order to establish whether or not an asset has a reasonable price, the Capital Asset Pricing Model (CAPM) applies the ideas of Modern Portfolio Theory. Systematic deposit plans offer a consistent and disciplined approach to investing, aligning with the Capital Asset Pricing Model’s emphasis on risk-adjusted returns. It is based on assumptions about the behaviors of investors, the risk and return distributions, and the fundamentals of the market, which do not reflect reality.

However, the fundamental concepts of CAPM and the associated efficient frontier can assist investors in better understanding the relationship between expected risk and reward as they make decisions regarding the addition of securities to a portfolio.

Author’s Bio:

Samuel Dawson loves helping others to thrive online through Social Media, Blogging, and SEO. He has 30+ years of experience in marketing/advertising with 10 years of experience in content marketing, social media, blogging, and SEO. Therefore he has written an article Capital Asset Pricing Model to spread the awareness of CAPM in debit cards.